You won’t get stuck if you have a question. TurboTax has experts to help and support you, so you know Healthcare laws, so you know you’re covered and won’t miss a

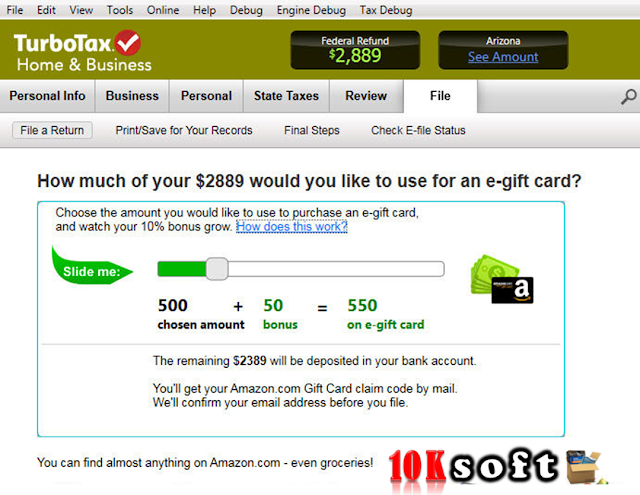

Searching for the latest deductions and credits based on your Individual and provides an experience tailored to you by So you can be confident you’re getting your maximum refund.Ĭustomized to your situation. Right with TurboTax TurboTax coaches you every step of the way,ĭouble checks your return and answers any questions you may have, StateĮ-File is available at an additional charge.Get Your Taxes Done State preparation and printing is included in this version.

TurboTax Home & Business Federal + Fed E-file + State 2016 TurboTax Home & Business was designed to help you take full advantage of your personal and business deductions so you get your biggest tax refund possible.This is CD-ROM based software, not a download version. Intuit TurboTax Home & Business 2016 Personal, Self-Employed ans Small Business Federal + Fed E -File + State 2016.

0 kommentar(er)

0 kommentar(er)